Introduction

Board feet remain the fundamental unit for quantifying lumber volume in North America. By linking cross-sectional dimensions to length, the board foot formula converts raw measurements into a standard unit—144 cubic inches—that underpins material estimation, cost analysis and contract pricing. Understanding how to calculate board feet manually establishes the groundwork for interpreting market quotes, negotiating supply contracts and leveraging digital calculators. This article examines the mechanics of board-foot calculation, surveys lumber pricing systems—from spot retail to futures markets—evaluates factors driving price volatility and provides actionable guidance for practitioners in forestry, construction and woodworking.

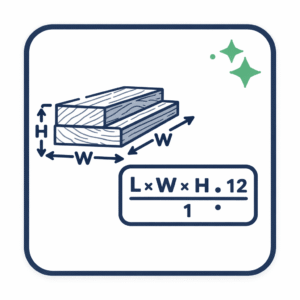

Fundamentals of Board-Foot Calculation

By definition, one board foot (BF) equals 144 cubic inches of wood (1 in × 12 in × 12 in). The board foot formula applies mixed-unit dimensions:

Board Feet = (Thickness in inches × Width in inches × Length in feet) ÷ 12

• Thickness (in) × Width (in) yields cross-sectional area in square inches.

• Multiplying by Length (ft) introduces linear dimension in feet.

• Division by 12 converts in²·ft to in³ (12 in²·ft = 144 in³).

A 2 in × 6 in × 8 ft board thus computes as (2 × 6 × 8) ÷ 12 = 8 BF. Mastery of this relationship is essential for verifying supplier quotes and reconciling physical deliveries.

Spot Retail Pricing

Retail Cost per Board Foot

Retail lumber dealers typically quote prices in dollars per board foot for various species, grades and moisture conditions. As of December 31, 2025, U.S. spot softwood lumber prices averaged 539 USD per 1,000 BF (0.539 USD per BF). Trading Economics

Composite Indices

The National Association of Home Builders publishes a framing lumber composite. On September 19, 2025, the composite price fell 11.2 percent over the prior month and 6.5 percent year-over-year. NAHB

Futures Markets

Contract Structure

Lumber futures trade on the Chicago Mercantile Exchange (CME) in contracts of 27,500 board feet, quoted in U.S. dollars per 1,000 BF. CME Futures

Recent Trading Activity

As of December 31, 2025, contract settlement price was 539 USD per 1,000 BF. Trading volume stood at 800 contracts, with open interest of 9,884, signaling moderate market engagement. CME Data

Supply-Side Influences

Tariffs and Trade Measures

U.S. countervailing duties on Canadian softwood imports rose from 14.4 percent to 35.2 percent in August 2025. With Canada supplying roughly 25 percent of U.S. lumber, these tariffs contributed to price rises into late 2025. The NAHB recommended negotiating a long-term trade agreement to stabilize costs. NAHB

Domestic Production Constraints

Bottlenecks at sawmills—due to labor shortages and maintenance backlogs—have limited throughput. Forest Economic Advisors projected U.S. framing lumber demand growth of 1.6 percent with a 16 percent price surge in 2025. Forest Economic Advisors

Demand-Side Dynamics

Residential Construction

Housing starts rose to 1.5 million units in 2025, up 11 percent year-over-year, sustaining framing lumber consumption. U.S. Census Bureau

Remodeling and Repair

Repair and remodeling spend—accounting for roughly 35 percent of softwood consumption—remained robust, with homeowners seeking energy-efficient updates. Weather-related damage remediation in the Southeast further boosted regional lumber offtake.

Price Volatility and Risk Management

Historical Volatility

Lumber prices have swung dramatically, from under 300 USD/1,000 BF in early 2020 to peaks above 1,500 USD/1,000 BF. Current futures implied volatility stands near 35 percent, underscoring persistent uncertainty in supply-demand balances.

Hedging Strategies

Contractors can mitigate exposure by:

- Purchasing futures contracts to lock in costs.

- Establishing cost-plus supply agreements with local mills.

- Holding safety-stock buffers equivalent to two weeks of needs.

Technology and Pricing Transparency

Digital Marketplaces

Platforms such as TimberExchange and LumberGuide offer live price dashboards and allow spot transactions in board-foot lots, narrowing bid-ask spreads. Real-time board foot formula widgets on these sites reinforce trade accuracy.

Automated Measurement

LiDAR and structured-light scanners at sawmills feed 3D volumetric data into pricing engines. By linking mill yields to real-time how to calculate board feet logic, these systems generate dynamic price quotes aligned with actual inventory.

Common Calculation Pitfalls

- Unit Mismatch: Entering length in inches instead of feet multiplies results by 12.

- Nominal vs. Actual Dimensions: Using nominal sizes for surfaced lumber overstates volume by 14–25 percent.

- Defect and Waste Exclusion: Failing to factor in 5–10 percent defect and machining waste leads to shortages.

Negotiation and Contract Strategies

- Price Escalation Clauses: Tie spot price adjustments to a published index (e.g., CME futures).

- Volume Discounts: Secure tiered pricing (e.g., 0.515 USD/BF for orders > 50,000 BF).

- Fixed vs. Floating Terms: Choose fixed pricing for budget certainty or floating terms with caps.

Final Considerations

Board-foot measurement and pricing converge into a complex, data-driven marketplace. Mastery of how to calculate board feet via the board foot formula empowers stakeholders to verify quotes, audit deliveries and negotiate contracts effectively. By understanding spot and futures mechanisms, incorporating trade-policy impacts, leveraging digital marketplaces and embedding risk-management tactics, organizations optimize material costs while maintaining supply continuity. Vigilant measurement practices and transparent pricing frameworks ensure lumber transactions remain precise, fair and aligned with evolving market dynamics.